OFAC Licensing Attorney

Free Case EvaluationNavigating Licensing Requirements with Expertise.

At Sanctions Law Center, we make navigating U.S. sanctions compliance straightforward and achievable. Our experienced team works closely with you to ensure you meet all legal requirements while sidestepping potential compliance challenges. We help you determine whether a general OFAC license covers your needs or guide you through the process of obtaining a specific OFAC license if necessary. With our tailored, expert advice, you’ll be equipped to handle the complexities of economic sanctions law confidently and efficiently.

What is an OFAC License?

The U.S. Treasury Department’s Office of Foreign Assets Control (OFAC) issues licenses that permit specific transactions or activities otherwise restricted by U.S. sanctions regulations. These licenses, issued as either general or specific, help mitigate the unintended impact of sanctions on sectors or transactions with humanitarian or other critical purposes. Understanding the difference between the two is crucial: a specific license requires a formal application and explicit OFAC authorization, while a general license is pre-authorized and applies automatically if your transaction and conduct fall within its specified scope and parameters.

Understanding OFAC Licenses: General vs. Specific

It’s crucial to distinguish between the two types of OFAC licenses—general and specific.

General Licenses outline permissible categories of transactions or industries and are either embedded within sanctions programs or issued separately by OFAC. Since general licenses do not require an application or prior approval, they allow for pre-authorized transactions if the conduct strictly aligns with the license’s terms. However, compliance teams at financial institutions may not always be familiar with the nuances of every applicable license, which often leads to errors or delays. Consulting a knowledgeable OFAC sanctions attorney ensures your transaction is compliant with the general license parameters, helping you avoid legal penalties, blocked funds, or interrupted transactions.

Specific Licenses, in contrast, require a formal application and explicit OFAC review and authorization. These licenses involve a detailed assessment of your proposed conduct, the nature of the transaction, the relevant industry, and all involved parties. Since OFAC does not provide a standard application form or clear-cut criteria for specific licenses, working with an experienced sanctions attorney is essential to maximize the likelihood of a favorable outcome. A skilled professional can navigate the complexities of the application process, tailoring each request to align with OFAC’s requirements.

If your business operates in sanctioned regions or involves transactions with restricted parties, securing the appropriate OFAC license is critical to continue operations in compliance with U.S. law. An OFAC license serves as official authorization for certain otherwise prohibited activities, and would help manage your compliance risks and align your transactions with U.S. sanctions policy.

Our team is equipped to prepare tailored applications that meet OFAC’s requirements, helping you mitigate sanctions enforcement and designation risks.

If a prohibited transaction or activity is not authorized under a General License, your business may need to apply for a Specific License. In this case, an OFAC sanctions attorney can prepare a formal request to OFAC seeking authorization for the transaction. This process involves gathering all relevant documentation, such as identifying records, invoices, and other supporting evidence, to substantiate the request.

There are multiple types of Specific License applications, each with detailed instructions provided by OFAC. Preparing these applications requires specialized skills and a thorough understanding of OFAC’s regulatory framework.

It’s important to note that Specific Licenses are non-transferable and are limited to the specific facts and circumstances of the application. OFAC reserves the right to modify or revoke a license at any time. Therefore, it is essential to consult the terms of the license regularly to ensure compliance. Additionally, all information submitted in the application must be truthful and accurate; failure to meet this standard may void the license and expose the applicant to liability.

How to submit a License Application to OFAC?

If a prohibited transaction or activity is not authorized under a General License, your business may need to apply for a Specific License. In this case, a OFAC sanctions attorney can prepare a formal request to OFAC seeking authorization for the transaction or proposed conduct, which would otherwise be prohibited. This process involves gathering all relevant documentation, such as identifying records, invoices, and other supporting evidence, to substantiate the request.

There are multiple types of Specific License applications, each with detailed instructions provided by OFAC. Preparing these applications requires specialized skills and a thorough understanding of OFAC’s regulatory framework.

It’s important to note that Specific Licenses are non-transferable and are limited to the specific facts and circumstances of the application. OFAC reserves the right to modify or revoke a license at any time. Therefore, it is essential to consult the terms of the license regularly to ensure compliance. Additionally, all information submitted in the application must be truthful and accurate. Failure to meet this standard may void the license and expose the applicant to sanctions liability.

What is the timeline for specific license application?

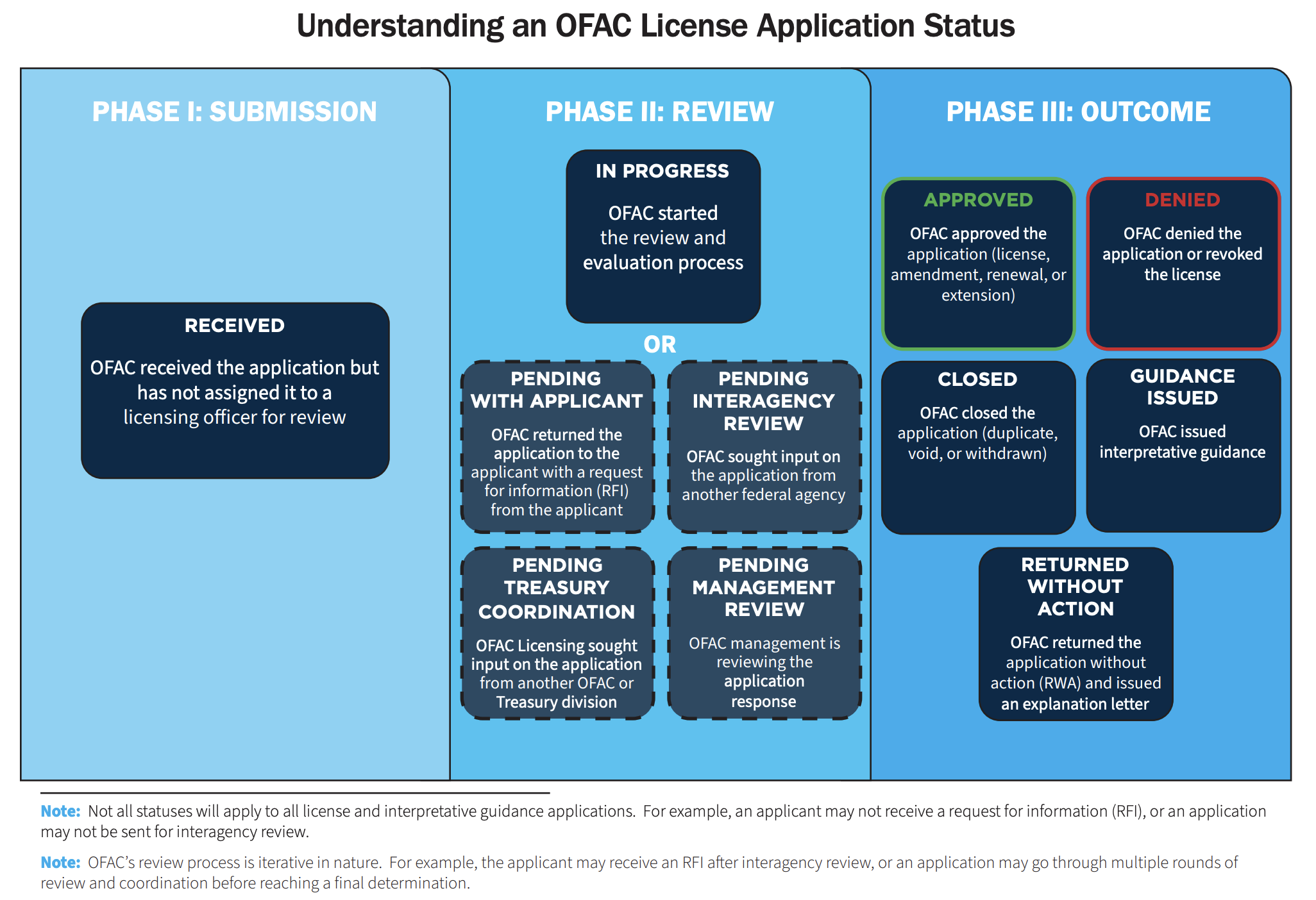

While OFAC cannot guarantee a specific processing time for license applications, it has improved transparency by providing status updates that help applicants understand the review timeline. Once your application is submitted, our firm can monitor its progress and keep you informed at each stage.

- Received

- Guidance Issued

- Returned Without Action

- Pending Management Review

- Pending Interagency Review

- Pending Treasury Coordination

- Pending with Applicant

- Approved

- Denied

- Closed

The Outcome

OFAC may either grant or deny a license request. OFAC’s decision is considered a “final agency decision.” However, the agency may conduct a bona fide review if the applicant can demonstrate a significant change in circumstances that could affect the outcome. If your license request is denied, our law firm can assist in re-submitting the request for reconsideration by OFAC. Alternatively, if further review is not feasible, we also provide support for pursuing an appeal in federal court.

Why hiring skilled attorneys matters?

Navigating U.S. sanctions regulations and license requirements can be complex and challenging. Understanding the intricacies of various sanctions programs and the parameters of license exceptions is essential to achieving a successful outcome in your license application. A skilled sanctions attorney not only assists with the application process but also helps your business communicate effectively with financial institutions and other entities that may be unfamiliar with OFAC regulations or the validity of an OFAC license. This proactive approach mitigates risks, helping to prevent unnecessary fund blockages or delays. If your funds are at risk of or have already been mistakenly blocked, our firm can assist in obtaining an OFAC unblocking license to minimize disruptions to your operations. Our team is here to guide you through these processes, ensuring compliance and reducing risk at every step.

Contact the Sanctions Law Center or call (202) 914-1545 today to learn how we can assist with your OFAC licensing needs to help you maintain seamless operations while staying within regulatory bounds.